Highlights From the Real Estate Board, June 2020

“REALTORS® continue to optimize new technology tools and practices to help their clients meet their housing needs in a safe and responsible way. Over the last three months, home buyers and sellers have become more comfortable operating within the physical distancing and other safety protocols in place.”

“Much more of the real estate transaction is happening virtually today. Before considering an inperson showing, REALTORS® are helping potential buyers pre-screen homes more thoroughly by taking video tours, reviewing floorplans and an increased number of high-resolution images, as well as often driving through the neighborhood.”

“Home prices have remained steady with minimal fluctuation over the last few months,” Gerber said. “With increasing demand, REALTORS® have begun seeing multiple offers for homes priced competitively for today’s market.”

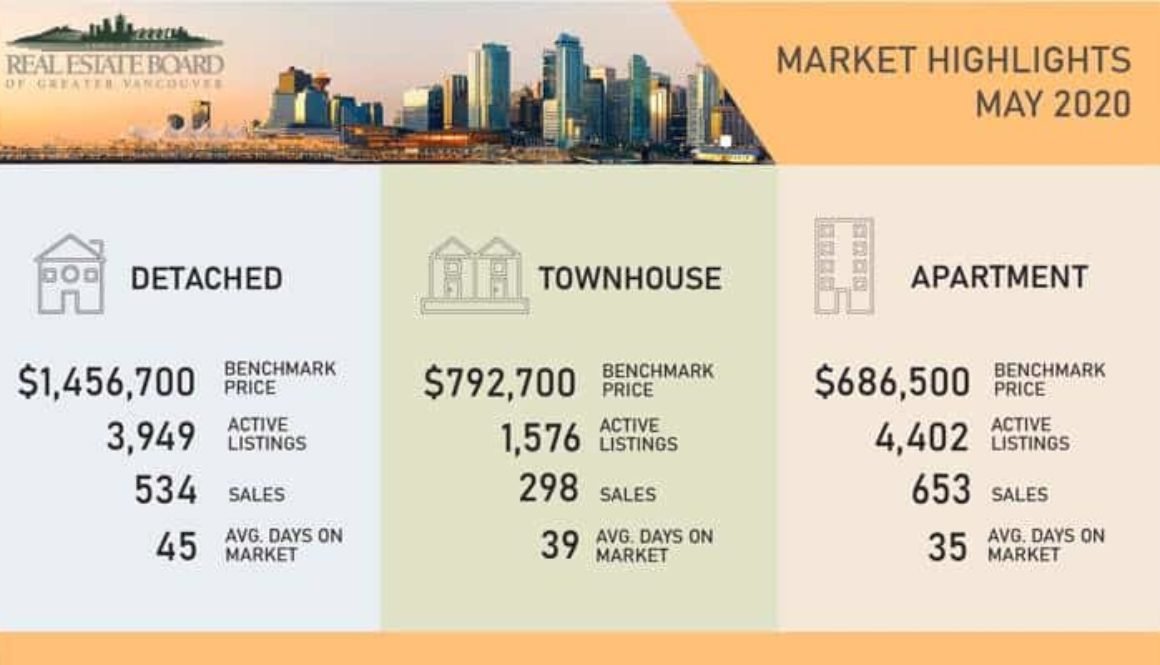

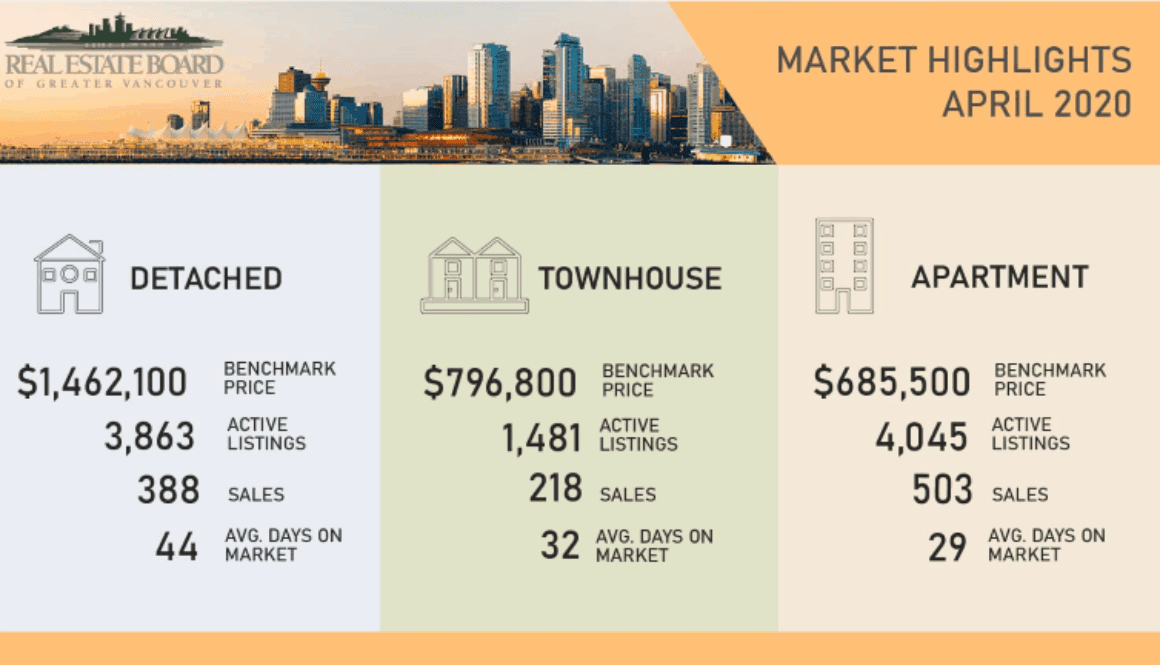

Sales of detached homes in June 2020 reached 866, a 16.1 per cent increase from the 746 detached sales recorded in June 2019. The benchmark price for a detached home is $1,464,200. This represents a 3.6 per cent increase from June 2019 and a 0.5 per cent increase compared to May 2020.

Sales of apartment homes reached 1,105 in June 2020, a 17.4 per cent increase compared to the 941 sales in June 2019. The benchmark price of an apartment property is $680,800. This represents a 3.6 per cent increase from June 2019 and a 0.8 per cent decrease compared to May 2020.

“NOTE: this representation is based in whole or in part on data generated by the Chilliwack & District Real Estate Board, Fraser Valley Real Estate Board or Real Estate Board of Greater Vancouver which assume no responsibility for its accuracy.”

Download The Real Estate Board of Greater Vancouver’s June statistics Package. Click Here

Download Fraser Valley’s Real Estate Board’s June Statistics Package. Click Here